On this page

The European Union (EU) has developed a comprehensive contract on how it works within the EU. This contract explicitly prohibits government or government support that could give the supported companies an unfair competitive advantage. Therefore, the de minimis regulation was introduced to limit the amount of state support that a company can receive, without the funds threatening the competitiveness of other market participants.

The de minimis regulations cover state subsidies granted to companies in the European Union (EU) and its member states. They are characterised by a small amount of aid and less stringent notification requirements .

The aim of the de minimis rule is to reduce the administrative burden on small and medium-sized enterprises (SMEs) and to facilitate access to funding.

What is the De-minimis regulation?

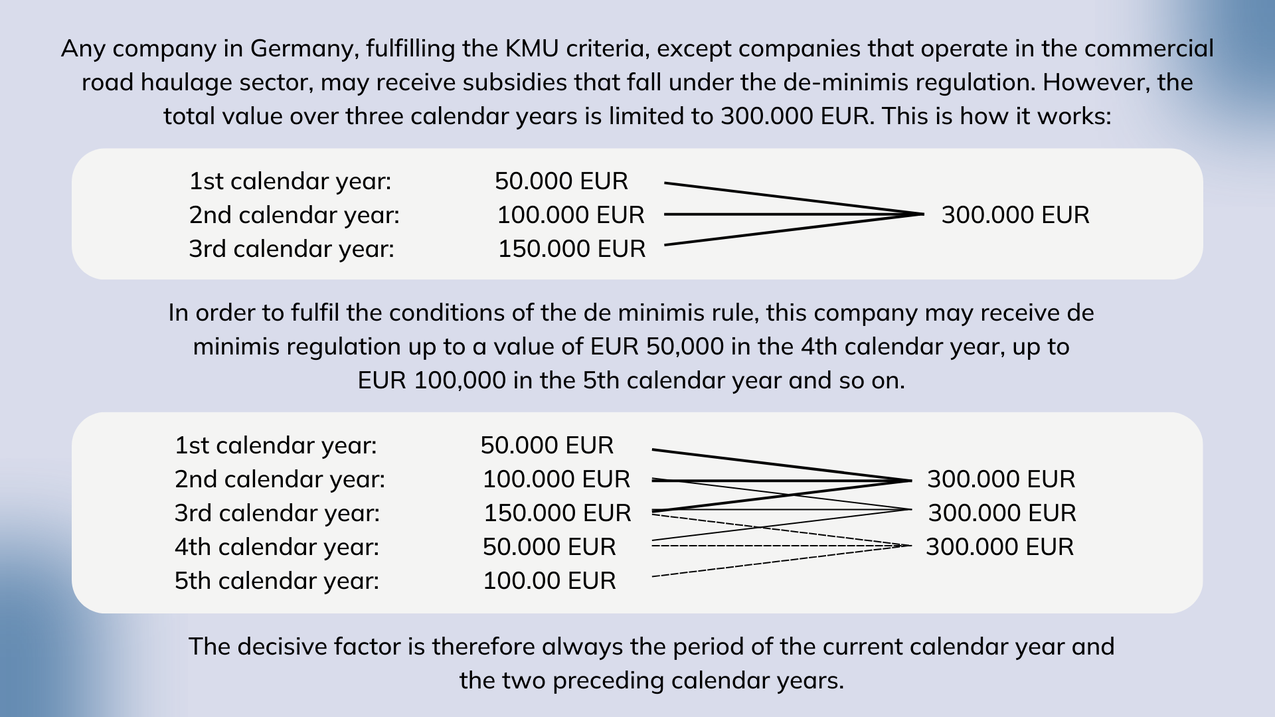

De minimis regulation is state subsidies that companies in Germany and the EU can receive in compliance with the SME criteria. This support is limited to a total amount of 300,000 euros over a rolling period of three calendar years. This is not an independent funding programme, but a general regulation that enables financial assistance through various funding programmes.

Only measures whose financial benefit can be clearly determined in advance are eligible for funding under the de minimis rule. These include grants in particular, but also, under certain conditions, loans, guarantees and participations.

A new de minimis aid can only be granted if the maximum amount of EUR 300,000 is not exceeded within the current three-year period.

Types of De-minimis aid

There are different types of funding programs that fall within the de minimis regulations and can be granted for different purposes.

The most common types include:

- Investment aid: This aid can be granted for the purchase of new machinery, equipment or other investments.

- Operating grants: These subsidies can be granted for ongoing operating costs such as rent, energy or personnel costs.

- Consultancy and training allowances: These allowances may be granted for the use of consultancy or training services.

- Research and development aid: This aid can be granted for research and development projects.

Conditions for granting De-minimis regulations

In order to receive de minimis regulations, companies must meet various conditions.

These include, but are not limited to:

- The company must be established in the EU or one of its member states.

- The undertaking shall not have difficulties within the meaning of Article 187(2) TFEU.

- The regulations may not be used to finance activities prohibited by the EU or its Member States.

- The De-minimis regulation applies in principle to aid to companies in all sectors of the economy.

However, there are exceptions for companies from the following sectors:

- fisheries and aquaculture

- primary agricultural production

- processing and marketing of agricultural products

- certain export-related activities

- for the purchase of vehicles for road freight transport

Applying for De-minimis regulations

De minimis regulation is usually applied for from the competent authority of the Member State concerned. Applications must contain various information, such as the type of funding, the intended use and the amount of aid requested.

What you should consider when applying for de minimis regulations

- Before applying, find out exactly what the requirements and funding conditions of the individual funding projects are.

- Make sure that you have completed all the required documents completely and correctly.

- Keep all evidence of the use of the aid.

- Please note the deadlines for applying for de minimis aid.

Example 1

Three-year period based on general de minimis aid:

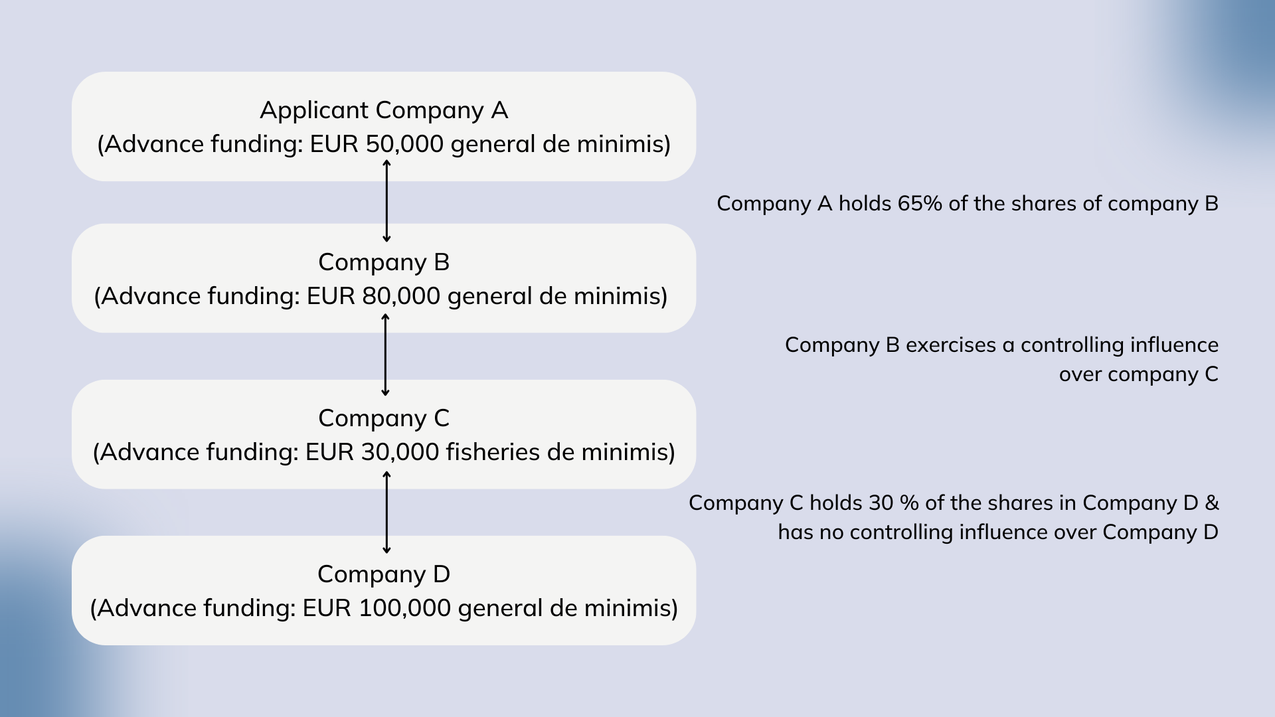

Example 2

Group of companies – a single company:

Question: Which companies together are to be considered as a single company within the meaning of the de minimis rule?

Answer: Companies A, B and C form a single company within the meaning of the de minimis rule. Company D is not part of the group because company C does not hold the majority of the shares in company D. The advance funding thus amounts to EUR 160,000. Accordingly, there is still a funding opportunity of EUR 140,000 for general de minimis aid.

Learn more

For more information on de minimis aid, please visit the following websites: