On this page

It’s tough to know how to estimate your revenue growth rate perfectly, isn’t it? Well, it turns out, you can dramatically have an impact on the quality of your estimation. And a better quality means a higher chance to convince investors.

Knowing your business Revenue Growth Rate is Key

Estimating your revenue growth rate accurately can indeed be challenging. However, there are best practices and revenue growth strategies you can employ to improve the quality of your estimations and even explore new markets. One effective approach is to conduct thorough market research and analyze industry trends to make informed projections. By understanding your target market, consumer behavior, and competitive landscape, you can make more precise revenue forecasts.

Additionally, utilizing financial models and forecasting tools can help streamline the estimation process and provide valuable insights into potential growth opportunities. By incorporating historical data, key performance indicators (KPIs), and scenario analysis into your revenue projections, you can enhance the reliability of your estimates.

Moreover, regular monitoring and adjustment of your revenue growth assumptions based on real-time performance data can further refine your forecasts. This iterative approach allows you to adapt to changing market dynamics and optimize your revenue projections over time.

Ultimately, by demonstrating a well-researched and data-driven approach to estimating your revenue growth rate, you can boost investor confidence in your business prospects and increase the likelihood of securing funding for your ventures.

What is Revenue Growth Rate?

Understanding the revenue growth rate involves predicting the potential increase in revenue over a specific period, such as week to week, month to month, or year to year.

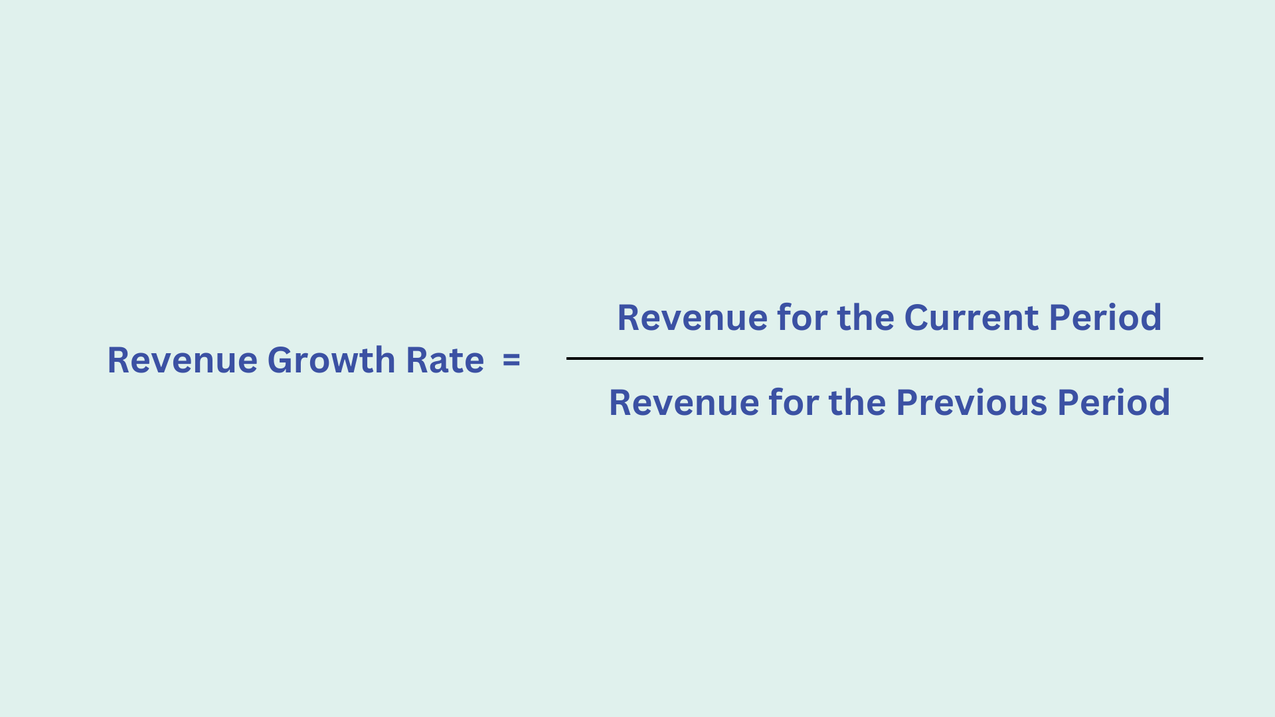

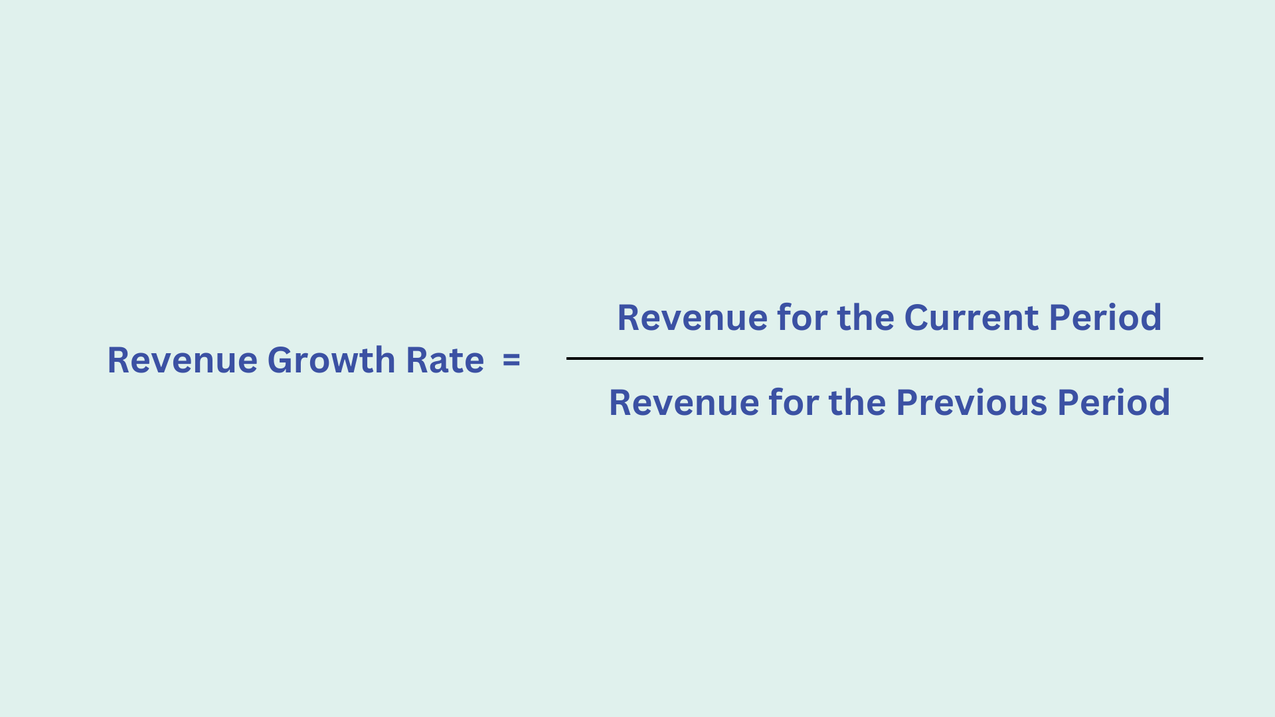

The formula to calculate the revenue growth rate is relatively straightforward:

When considering the period you need, it's essential to understand your specific requirements and goals. Whether you're analyzing data, studying trends, or conducting research, selecting the right time frame is crucial for obtaining accurate and relevant insights. For instance, if you are examining sales performance, a monthly or quarterly period might be suitable to identify patterns and fluctuations. On the other hand, for long-term strategic planning, an annual or multi-year period could provide a comprehensive overview of growth and challenges.

Later on, we'll delve into specific examples to illustrate how choosing the appropriate period can significantly impact the outcomes of your analysis or research.

Why is Revenue Forecasting important?

Forecasting revenue is crucial for positioning your company against others, especially for investors seeking a favorable return. Investors will prefer a return of approximately 400% on a relatively new start-up than having a return of 120% on an established business. However, there are multiple factors that play into account when investors are looking at a company’s growth rate. They are knowledgeable about the market and are not swayed by unrealistic high growth rates; instead, they prefer start-ups that can meet their objectives.

Accurate revenue forecasting is essential for making informed financial and business decisions. By predicting future revenue streams, companies can allocate resources effectively, plan for expansion, and make strategic decisions to drive sustainable growth. Revenue forecasts also help in setting realistic goals, monitoring performance against targets, and identifying areas for improvement.

Moreover, advanced analytics and revenue forecasting provide valuable insights into market trends, customer behavior, and the overall health of the business, especially regarding new products. It enables companies to adapt to changing market conditions, seize opportunities for growth, and stay ahead of competitors. Ultimately, incorporating revenue forecasting into your financial and business strategies can enhance decision-making processes and pave the way for long-term success.

This article is being done for that exact reason, as it could be a crucial component absent from your financial and business plans.

Are Earning Predictions included in your Company Analysis?

Maybe you have read our ultimate financial plan guide, so this point might sound familiar. One of the most important reasons for becoming better at estimating your company's growth rate is the company analysis for understanding the company’s performance and overall business performance, including its market position, in your financial plan. The financial plan is THE most essential element when it comes down to convincing investors of your company's worth, especially in today's unpredictable market conditions. It sounds like it makes sense to get the estimation of your sales growth rate as good as possible, right? This is precisely why we are here - to assist you in grasping this pivotal metric.

Eager to dive into practical insights? Keep reading.

What is the Method for Calculating Revenue Growth Rate?

Sounds easy, right? But wait a second. As easy as it may sound, this question has depth to it. To help with your estimations in the most beneficial way, we will take a look at the most asked questions around the subject of revenue growth.

Additionally, at the end of this section, we will look at some interesting real-life examples of revenue growth rates.

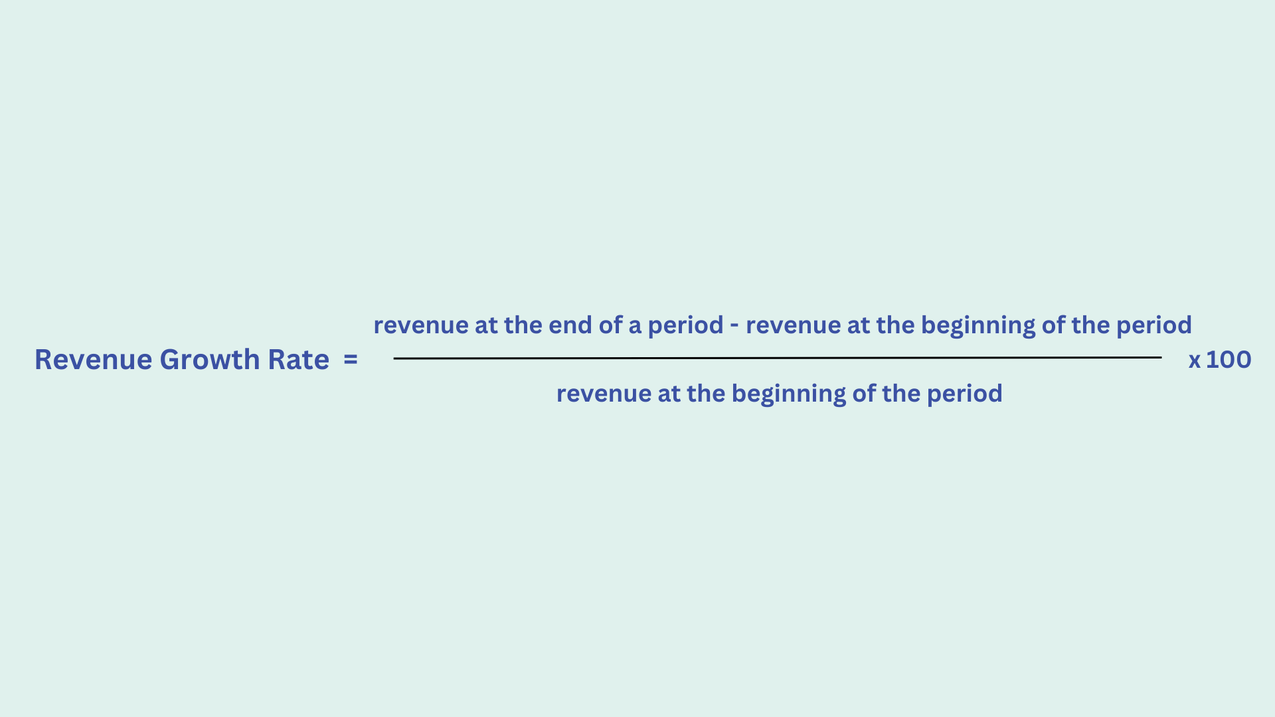

Revenue growth rate is calculated by using this formula:

How to predict a Company's Growth Rate

By utilizing historical data, you have the advantage of being able to make remarkably precise estimations.

What is historical data? Glad you asked: Historical data stands for any information that you could gather in your company’s lifecycle.

One approach to analyzing historical data could be to take a broad perspective on your revenue across specific time frames. Consider the past 5 to 10 years to identify when your company experiences peaks and valleys. This could be before, during, and after Christmas, or possibly during the summer due to the popularity of your seasonal articles. Utilize this data to make distinctions in your analysis.

Having someone who can review and improve your predictions using your past data (and possibly data from others' experiences) can help you succeed. Many marketers prefer to make special offers based on their analysis of past data. For example, if sales were high before Christmas, they might create unique gift promotions. Remember: More data means more evidence. And investors love proof.

How to Forecast Revenue Growth Rate for a Start-Up

Let's examine projecting revenue growth rates for startups now. While it may be a bit more intricate, it is still achievable. Here, we aim to distinguish between early-stage startups and established ones. For young startups, it is advisable to estimate the weekly revenue growth rate using weekly data instead of monthly or yearly data, which is unavailable in the early stages of starting a business.

The formula remains the same:

Compare weekly or bi-weekly data, or data from last month or last year. Early-stage startups may experience significant exponential growth, which can be misleading for long-term revenue growth estimates. However, incorporating this information is beneficial and valued by investors. If you anticipate that the revenue growth rate is unsustainable for the next three years, consider breaking down the estimation into shorter periods: the next six months, the next year, and the next three years. This approach enhances credibility.

Investors, banks, and other institutions will acknowledge that you know how growth works, including the concept of compound annual growth rate and the rate of growth within a specific time period. They will love you for your ability to show how important it is to give the most accurate information possible. There is a massive difference between having a 180% growth rate for three years and having 180% for the first year, but then dropping down to 120% in the following two years – which you can sustain on average.

Example of Revenue Growth Rate in Start-Ups

Examples serve as powerful tools to enhance understanding and clarity on a given topic. By illustrating concepts through real-life scenarios or instances, complex subjects can become more digestible and relatable to the audience. We were successful in finding some examples with compelling data on revenue growth rate in the start-up-scene.

Revenue Growth Rate by Industry

A company's ideal revenue growth rate varies based on factors like industry, country, and economic conditions. Analyzing revenue growth in French startups in 2018, those with revenue between 0 and 5 million euros saw a good growth rate of approximately 35%, while established startups with over 50 million euros revenue had a growth rate of about 16%. This data indicates that early-stage startups achieved over double the percent increase in revenue growth compared to established companies.

Ready for Growth?

Estimating your revenue growth rate presents a significant opportunity for your business's success. To maximize this opportunity, it is crucial to take a comprehensive view of all potential factors and how they align with your overall business development strategy.

Our team of experts specializes in business and startup growth strategies, backed by extensive experience in creating award-winning business plans. We are equipped to assist you in accurately estimating your revenue growth rate and ensuring that it aligns seamlessly with your business objectives.

By leveraging our expertise, you can gain valuable insights into forecasting your revenue growth, identifying key performance indicators, and developing strategies to drive sustainable business growth. Let us guide you in optimizing your revenue projections and setting a solid foundation for achieving your business goals.

Ready for growth?