On this page

- Tax code distinction in Europe

- Steuernummer vs. VAT ID: Which is which?

- Steuernummer: The tax number on invoices within Germany

- VAT ID: The tax number on invoices to other EU countries

- VAT ID for B2B transactions

- How to get a VAT ID number?

- What must appear on a German invoice?

- Tax number on invoices under 250 euros?

- Support and Help

Every entrepreneur who writes an invoice for the first time is faced with the question: Do I have to state the Steuernummer or VAT ID on the invoice? After all, both numbers can be stated on the invoice. Let’s find out which number is required when here.

- Tax code distinction in Europe

- Steuernummer vs. VAT ID: Which is which?

- Steuernummer: The tax number on invoices within Germany

- VAT ID: The tax number on invoices to other EU countries

- VAT ID for B2B transactions

- How to get a VAT ID number?

- What must appear on a German invoice?

- Tax number on invoices under 250 euros?

- Support and Help

Tax code distinction in Europe

In Europe, there are the three following tax codes:

- Tax number

- Tax identification number (Tax ID)

- Value-added tax identification number (VAT ID)

Steuernummer vs. VAT ID: Which is which?

There is not only one tax number for businesses – no: as an entrepreneur, you can have both a tax number and a turnover tax number (turnover tax ID). Both numbers are used equally for tax identification. Every taxable natural person or legal entity receives a tax number or, since 2008, a tax identification number (tax ID) from the tax office.

Steuernummer: The tax number on invoices within Germany

If you issue invoices to persons or companies that have their registered office in Germany as you do, it is generally sufficient to state the tax number or tax ID on the invoice.

If your customer is based in Germany, according to § 14 UStG, you may alternatively state your VAT identification number (VAT ID) instead of your Steuernummer.

Many entrepreneurs even prefer to provide their VAT ID voluntarily. It is more secure in data protection and offers fewer opportunities for misuse than the tax number. Steuernummer may also be referred as Steuer-Identnummer or St-Nr.

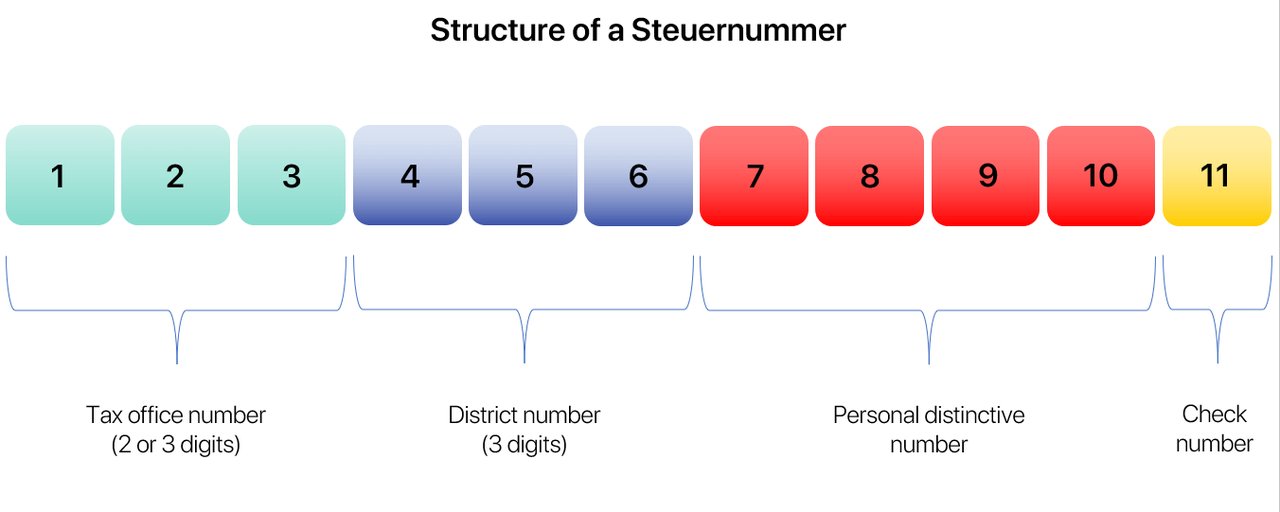

You can recognize it by its 11-digit structure:

VAT ID: The tax number on invoices to other EU countries

For invoices that you issue to customers in other EU countries, you need the VAT ID number in some instances.

VAT ID for B2B transactions

The VAT ID is mandatory if you, as a VAT-registered trader, issue an invoice to another trader in another EU country (B2B transactions) or as a seller outside the EU.

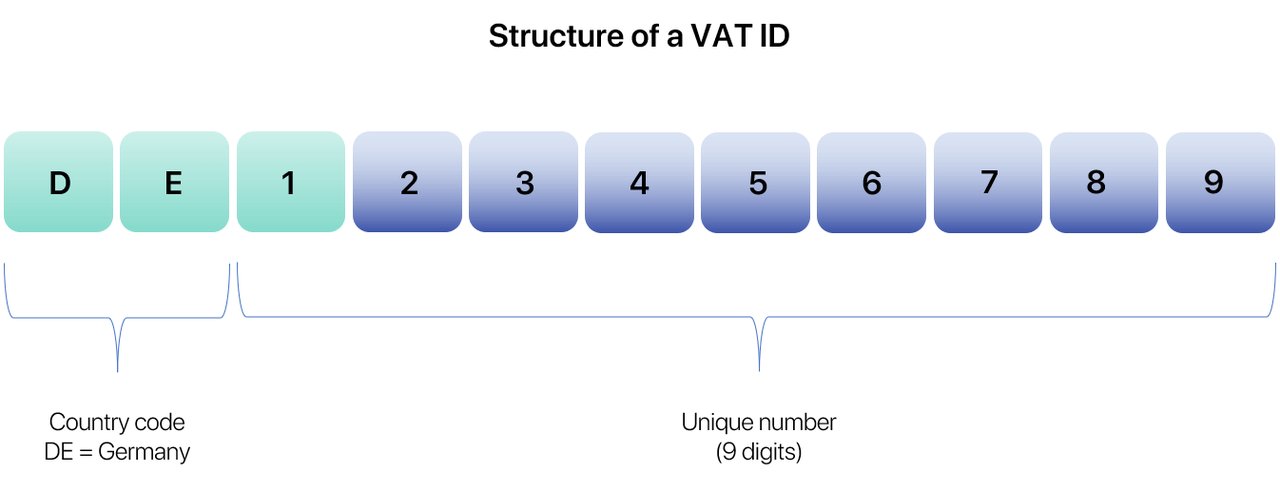

A VAT ID can only be issued to companies, and in some instances, it is your tax identification number for other EU countries. In other words, it may be required if you write an invoice to a business partner in another EU country. It’s a 9-digit number with the format “DE123456789”.

However, small entrepreneurs (Kleinunternehmer) do not need a VAT ID but apply for it anyway and use it on invoices or in the imprint. This is entirely legitimate. The background is often that they do not want to give their tax number and prefer the VAT ID.

VAT ID may also be referred as:

- Umsatzsteuer-ID

- Umsatzsteuer-Identifikationsnummer

- USt-Identifikationsnummer

- USt-IdNr.

The VAT ID is mandatory if you, as a VAT-registered trader, issue an invoice to another trader in another EU country (B2B transactions) or as a seller outside the EU.

A VAT ID can only be issued to companies, and in some instances, it is your tax identification number for other EU countries. In other words, it may be required if you write an invoice to a business partner in another EU country. It’s a 9-digit number with the format “DE123456789”.

However, small entrepreneurs (Kleinunternehmer) do not need a VAT ID but apply for it anyway and use it on invoices or in the imprint. This is entirely legitimate. The background is often that they do not want to give their tax number and prefer the VAT ID.

VAT ID may also be referred as:

- Umsatzsteuer-ID

- Umsatzsteuer-Identifikationsnummer

- USt-Identifikationsnummer

- USt-IdNr.

You can recognize the VAT ID by the structure of 11 digits and the preceding country code. As an entrepreneur in Germany, you have the abbreviation DE in your VAT ID:

How to get a VAT ID number?

When you register your business with the tax office and apply for a tax number, you can request the VAT-ID directly. Alternatively, you can apply online at the Federal Central Tax Office. Our full guide on how to apply for a German VAT number can support you with the application process.

What must appear on a German invoice?

In addition to your tax number or VAT ID, your invoice must state your full name and business address. The same applies to the address of your customer. Also, when using the VAT ID, make sure that the correct VAT ID of your customer is also on the invoice.

In addition, your invoice must include the following information:

- the date of the invoice

- a unique invoice number (e.g., from the first letters of your customer’s name – the number of the invoice – invoice month: JI-001-0919)

- quantity and article description or service

- date of service/delivery

- Net amount

- Tax rate (omitted for small entrepreneurs)

If you are a small entrepreneur, you must state the reason for your VAT exemption on the invoice: “No display of VAT, as small entrepreneur according to § 19 UStG”.

Don’t forget to include your bank details so that your customer can pay the invoice. I also recommend setting a payment deadline of 7 to 21 days for your customers. If the customer has not paid by then, you can simply follow up.

Tax number on invoices under 250 euros?

No! Invoices under 250 euros do not need to have a tax number at all in Germany. Such so-called small-value invoices are, for example, train tickets, fuel receipts, or cash register receipts.

Support and Help

You now know all the basics about the German Steuernummer and VAT number. The process of the application can still take a lot of time and experts like us can make sure that your application is successful and fast.

That’s why we’re here to help you out. Fill out the contact form or schedule a call here to directly get in contact with us.